No one- and I mean no one, likes managing their expenses. I don’t care if you are an analyst right out of school or a seasoned executive, preparing and submitting your expenses for booking and reimbursement is a tedious yet necessary evil that takes time and energy away from other things you would rather be doing. Best case scenario, you might find yourself in a sort of Stockholm syndrome with the whole process, finding comfort in the mundane and predictable nature of it all; like washing dishes or folding laundry.

I started my career at Aggrego and the first thing I had on my plate was solving expense management issues. Through a combination of digital tools, technologies and a new operating model, we were able to gain greater visibility into our spending, bill clients on time, improve cash flow, reduce costs and errors, and most valuably allow our consultants to spend less time and energy on expenses and recapture quality of life.

Background

Aggrego was a startup firm at the time. Many of our processes and procedures were put in place quickly to meet an immediate need rather than to be the most efficient. We were working on an engagement as part of a delivery consortium for a global insurance company. Our contracts required us to comply with their expense policy and maintain strict records of reimbursable expenses. Our work involved extensive domestic and international travel with expenses to be reimbursed on Net 30 day terms.

The expense process we had in place involved consultants submitting their expenses on an Excel template. They would email their report to a central mailbox with the necessary receipts scanned and included as attachments. This involved saving every receipt as they were traveling, finding time to carefully input them into a spreadsheet, scan and appropriately title all the receipts and ensure the numbers were all entered correctly and added to the totals.

Expense entry into our financial systems was a completely manual process. Every single line item of each expense report was typed into the accounting software. Not only was this time consuming, it was error prone requiring control processes at the time of invoicing and at close quarter.

All of this was increasing the time it took to invoice our client. Aggrego was forced to float the cost of these expenses, forcing us to keep additional funds on hand.

A Day in the Life of the Chief Digital Officer: Addressing the Expense Crisis.

I was tasked with addressing expenses right as travel demand began to increase rapidly. I had never dealt with travel and expenses (T&E) before and knew little about it. To better understand the process as well as the firms current state, I took over the expense approval and invoicing process.

Consultants were expected to email their expense reports to a central mailbox, where I could access them for processing. However, they would often email them directly to me or to the engagement manager.

As part of the approval process, I would check their reports for errors. This included visually confirming their reports against the receipts for the amounts, dates, vendors etc., ensuring expense types were correct and within policy, among other things. Errors and missing receipts would frequently result in email chains and delays in processing. In a high paced environment where a consultant’s primary focus is on meeting the deadlines of the client, housekeeping tasks such as revising expense reports often fell to the wayside, resulting in further delays to reimbursement.

My time processing expenses not only allowed me to see issues with the current process, I understood the pain points people faced dealing with the current process. Consultants who took shorter and recurring domestic trips would generally be able to turn around their reports within the week of their travel, but international trips generally took over a week to prepare and often required email chains. Many of these trips were to Japan and Korea where receipts were printed in Japanese and Korean, making it difficult to retroactively match them to the appropriate expenses.

Foreign exchange rates were a nightmare. We were invoicing our client in USD but expenses were often incurred in foreign currencies. With credit card transactions we could use account statements as a basis for FX but cash transactions required us to find currency exchange rates ourselves. Japan and Korea have highly automated payment systems and cash cards are frequently used which resulted in high volume of exchange rate matching and reconciliation.

As you can imagine, this process resulted in a significant number of errors. Consultants would often have errors with their exchange rates. Inevitably they would be missing receipts or amounts would not tally up. This would consistently result in long approval times for expense reports made worse by email chains and multiple versions of reports.

It became readily apparent to me that we needed a Digital solution.

The Digital Experience:

To better explain our eventual T&E solution, I think it is important that I outline what makes digital experiences different.

In the past, customer experiences were rigid. There was a product which you bought and you learned to work with it. It improved things for you, but you would have to adapt your workflow to the way it was designed. There were always competing products, but the “best” product was usually the one that performed the best or the one with the newest features, not necessarily the one that best fit the customer’s needs.

Then experiences were customizable. This allowed customers to modify products to fit their needs. While this freedom seems liberating, in the case of sophisticated experiences it can have the opposite effect. Customers might not know exactly what they want. With too many options it can become difficult to choose. In many cases, the customer might not be an expert on how a product works, rather they just want to use it. Providers face compatibility issues due to differing customizations. They might have to support different configurations of the same product, slowing down innovation. Customers might be able to customize their product to their specifications, but at the expense of simplicity, compatibility and speed. At the end of the day, they just want a product that works.

Imagine if you were buying a car and the salesperson asked you what kind of bolts you wanted to hold you wheels in place. One material could improve performance, whereas another could cause your wheels to fall off while driving and the decision is completely on you. This is an example of overwhelming customization.

Digital experiences are personal. They shouldn’t be rigid, forcing customers to completely change the way they do things. They also shouldn’t be overwhelmingly customizable. They should serve the customer with the best possible solution to their needs with minimal direct input.

Any Digital solution needs to provide a seamless experience. Fundamentally it serves to save time and reduce costs by automating the most tedious aspects of a process. Ideally, it should provide a less frustrating experience than the one it replaces and allow you to adapt to external pressures or changes within the organization. It should reduce errors while enabling your people to achieve greater outcomes with less labor. It is a customer centric solution, and in the case of expense management, the customers are the employees traveling, the engagement managers approving their expenses, the finance organization tasked with recovering client billable expenses and reimbursing funds to employees, audit, tax and the client.

An effective digital experience is one that seamlessly becomes part of your life. It should almost serve as an extension of your brain, streamlining tasks so that less of your conscious attention has to go to the gritty details.

A digital expense solution should travel with consultants, allowing them to capture expenses as they are incurred, rather than waiting to deal with them after traveling. You should find yourself handing the capture process over to your digital tool right after you finish a meal by taking a picture of the receipt rather than waiting until next week to handle it. Deal with the task as it occurs so it can be out of your mind as soon as it is out of your sight.

Digital experiences should allow you to be more connected. Consultants should be notified when reports are approved and if they have been returned for any reason. They should know who the preferred vendors are without having to reference policies. For managers, expense approval needs to be streamlined. They should be notified when expenses are outside of policy guidelines or when receipts are missing.

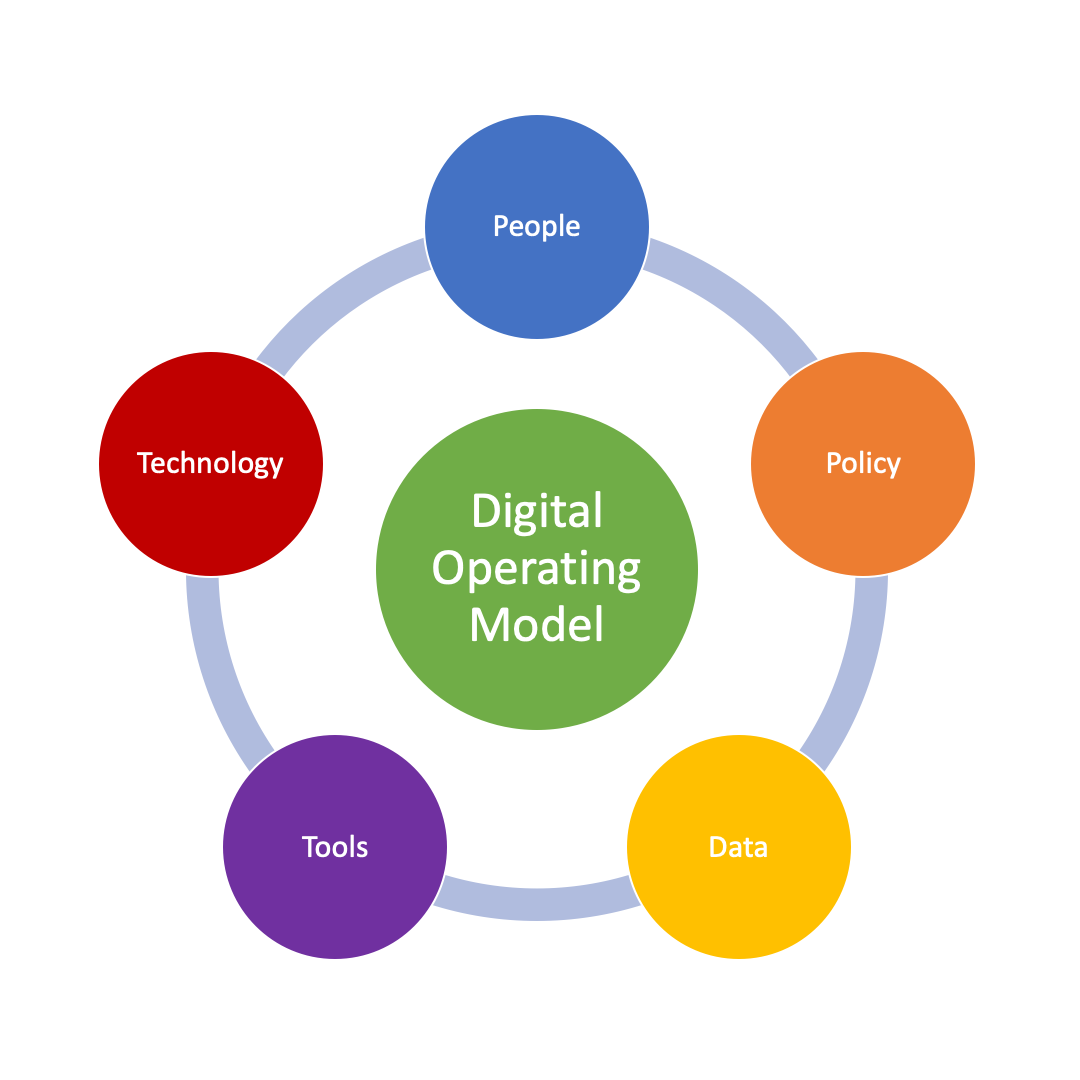

To better understand how an organization can deliver a seamless digital experience, it is necessary to consider the operating model.

The Digital Operating Model

Digital operating models are about more than cost reduction. While cost reduction is an easy win for firms that are pursuing digital operating models, the real benefits are gains in speed, scale and efficiency achieved by removing people from the critical path of the delivery process. Your people still play a significant role. They need to help design and improve processes. They can creatively solve problems in ways machines cannot. They need to create new products that allow you to expand into new markets. The digital operating model acts as a labor multiplier on your existing workforce. They allow your people to augment the outputs of their labor. That is, they can be more productive in less time.

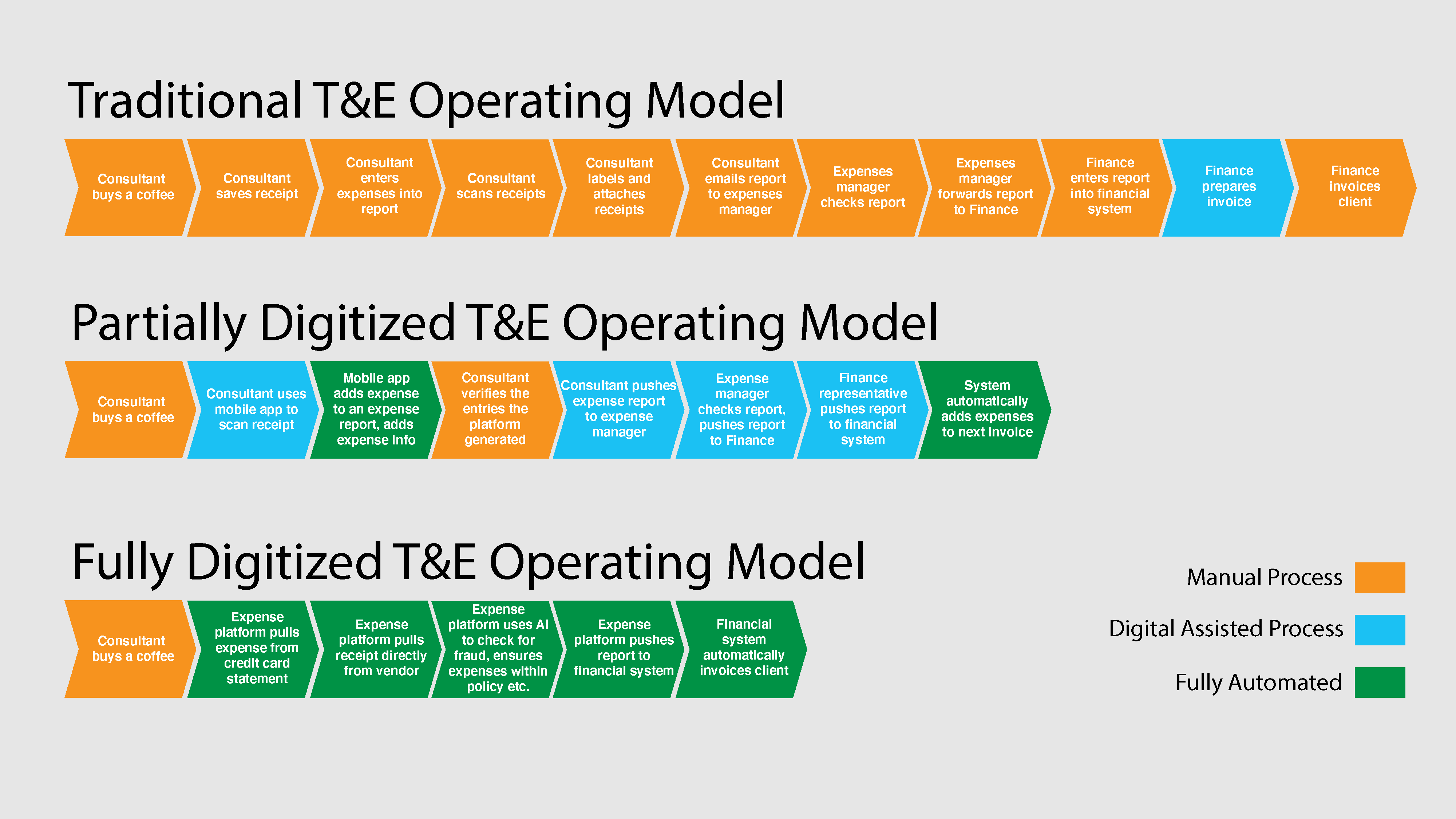

A fully digitized operating model is the one that has fewest possible manual processes in its critical path. While firms are striving for full digitization (which may or may not be possible today), manual processes can be augmented with digital tools. Digital tools are a spectrum of tools enabled by technologies such as Cloud, Big Data, Artificial Intelligence, and the Internet of Things. They often act as touch points or interfaces between individuals and the rest of the organization. Examples of these include robotic process automation, data analytics and visualization, machine learning models, cognitive automation, and so much more.

In the case of T&E, the optimal fully digitized operating model would eliminate the need for human intervention once an expense has been incurred. As soon as an individual swipes their card at a coffee shop, a series of automated processes instantly occur which result in the expense being booked to financials, prepared for reimbursement and invoicing along with any other processes that occur outside of the organization. If expenses are being billed to a client that has digitized their accounts payable, the transaction could be settled instantly. Essentially the transaction becomes a consultant buying a coffee and their client immediately paying for it, with all the intermediate steps being fully automated. It’s as if your client was standing next to you and swiped their card instead of yours.

Today, many of us are still using something between a manual process and a partially digitized operating models. Fully Digitized operating models are possible. They require extensive cooperation between vendors, platform providers and customers.

To finish off my story, I managed to get Aggrego to the partially Digitized operating model. The amount of time that we spend on expenses is a fraction of what we used to. The turn around time for reports can be measured in minutes, not days. We have gained new insights into our spending, and the time from approving an expense, sending it, and invoicing our client is nearly instant. But that isn’t good enough. I’m not happy with it yet. I know I will be standing in a coffee shop soon enough and I will receive a notification from my bank that reimbursement for the coffee I’m waiting for has been transferred to my account.

Footnote: For those interested, we implemented SAP Concur on the Cloud

Leave a Reply